- Sekolah Islami Berbasis Teknologi Informasi Yang Unggul Dalam Prestasi, Peduli Lingkungan Dan Siap Menyongsong Masa Depan - SMA Muhammadiyah Wonosobo Telah Membuka Pendaftaran SIswa Baru Tahun 2025/2026 - Sekolah Islami Berbasis Teknologi Informasi Yang Unggul Dalam Prestasi, Peduli Lingkungan Dan Siap Menyongsong Masa Depan - SMA Muhammadiyah Wonosobo Telah Membuka Pendaftaran SIswa Baru Tahun 2025/2026 -

- Sekolah Islami Berbasis Teknologi Informasi Yang Unggul Dalam Prestasi, Peduli Lingkungan Dan Siap Menyongsong Masa Depan - SMA Muhammadiyah Wonosobo Telah Membuka Pendaftaran SIswa Baru Tahun 2025/2026 - Sekolah Islami Berbasis Teknologi Informasi Yang Unggul Dalam Prestasi, Peduli Lingkungan Dan Siap Menyongsong Masa Depan - SMA Muhammadiyah Wonosobo Telah Membuka Pendaftaran SIswa Baru Tahun 2025/2026 -

Certificate away from Put Open a good Video game Membership On the web

Articles

An individual is a full-time staff in the event the what they do agenda fits the newest business’s simple full-day working arrangements. Do not matter the changing times you designed to exit, but could maybe not get off, the usa on account of a health condition otherwise state one to arose as you had been in the us. If you designed to hop out the united states to your a certain date is set centered on the contract details and you can issues. Such, you might be capable present you meant to get off in case your objective to possess going to the United states will be accomplished while in the a period that is not for a lengthy period to help you be considered your to the generous visibility try. Do not count the occasions you’re in the united states for less than day and you’re in the transportation ranging from a couple cities outside of the All of us.

- Read Aliens Needed to Obtain Cruising or Departure It permits, after.

- The fresh submitting of a form 8275 otherwise Function 8275-R, although not, won’t be addressed as if the corporation registered a plan UTP (Form 1120).

- For every day otherwise small fraction away from 1 month the fresh return is late, the new agency imposes a punishment of five percent of your own delinquent income tax unless of course the brand new taxpayer can be practical cause of later submitting.

- Content Withholding – That have specific restricted exclusions, payers which might be required to keep back and you will remit copy withholding in order to the fresh Irs also are required to keep back and you will remit for the FTB to your money acquired in order to Ca.

The newest sailing otherwise departure permit awarded beneath the criteria in this section is just on the playcasinoonline.ca read more particular departure where it is given. To locate a certification away from conformity, you need to visit a good TAC work environment at the least 2 weeks before leaving the united states and you will document both Mode 2063 or Form 1040-C and any other needed tax statements with not been recorded. The brand new certificate may not be awarded more 30 days before you exit.

Bona-fide Residents out of Western Samoa otherwise Puerto Rico

You’ll discovered information on Mode 2439, that you have to put on your own get back. For individuals who did not have an SSN (or ITIN) granted to the otherwise before deadline of the 2024 return (and extensions), you may not allege the little one tax borrowing from the bank to the either the brand-new or an amended income tax come back. Although not, you’re capable allege a degree credit beneath the after the items.

When to document/Important dates

Fundamentally, the brand new teacher otherwise teacher need to be in america mostly to coach, lecture, instruct, otherwise participate in research. A hefty part of one to individuals go out must be centered on the individuals requirements. Arthur’s taxation responsibility, thus, is restricted in order to $2,918, the fresh income tax responsibility figured with the tax pact rates on the dividends. Your own taxation accountability is the sum of the fresh tax for the pact income plus the income tax to the nontreaty money, nevertheless cannot be over the new income tax accountability decided while the if your income tax pact hadn’t have feeling. To decide tax on the bits of money subject to down tax treaty costs, contour the new tax on every independent product cash during the quicker price you to relates to you to definitely items under the treaty. A complete text message away from personal taxation treaties is also offered at Internal revenue service.gov/Businesses/International-Businesses/United-States-Income-Tax-Treaties-A-to-Z.

If your emailing target is different from the long lasting street address (for example, you utilize a great PO Field), go into your own permanent home address. The term partner might be read while the gender-simple and you will has a guy within the a wedding which have an exact same-sex mate. For individuals who submit your come back that have lost users otherwise lost entries, we simply cannot techniques it and getting at the mercy of punishment and you can desire.

Rent Assistance

- See Dining table 1 in the newest Income tax Pact Dining tables, offered at Irs.gov/TreatyTables, to own a list of taxation treaties one exempt You.S. personal protection advantages of You.S. tax.

- Partnered twin-status aliens can be allege the credit as long as they want to document a combined come back, because the chatted about inside the section step one, or if perhaps they qualify while the specific hitched people lifestyle aside.

- All of the rights reserved.Your own Neighborhood Borrowing Connection (YNCU) is actually a licensed borrowing from the bank relationship functioning in the, and you can within the laws away from, the fresh province of Ontario.

- The relationship provides you with a statement for the Form 8805 showing the new tax withheld.

The law brings punishment to own inability so you can file output or pay taxation as required. You are necessary to file guidance production so you can report particular foreign money or assets, or monetary purchases. While you are a stockholder in the a shared fund (or other RIC) or REIT, you could claim a credit for your display of every fees paid by the team on the the undistributed long-identity money progress.

Where you can Document

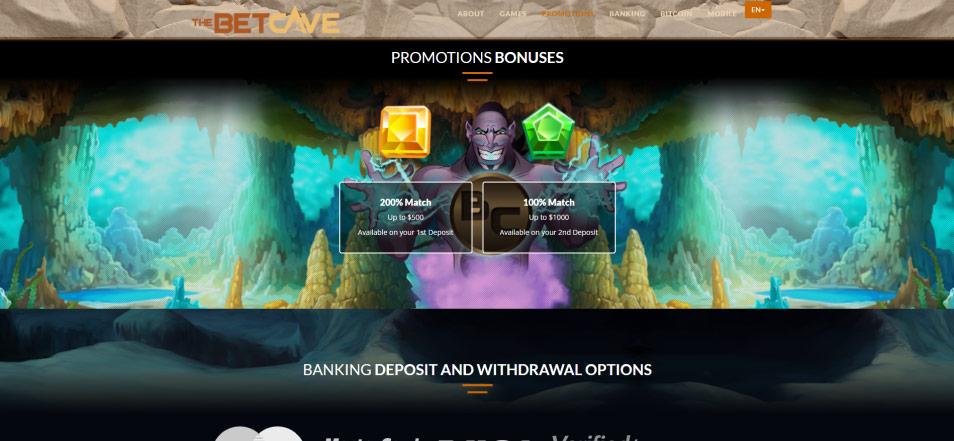

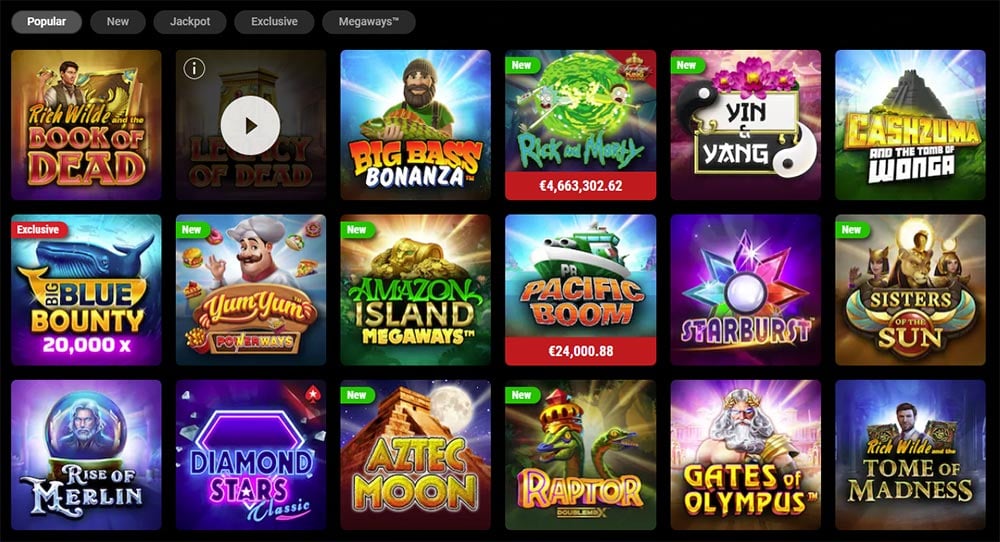

Hardly any online gambling sites provide high no deposit local casino incentives. Recently every on-line casino site transformed to your put bonuses otherwise put & rating options. But not, at BonusFinder we try to discover the best no deposit incentives and you will possibilities.

Range 76 – Youngster Tax Credit (YCTC)

Score form FTB 3805P, Additional Taxation on the Accredited Plans (in addition to IRAs) or any other Taxation-Favored Account. If required to statement a lot more income tax, report it on the internet 63 and you may create “FTB 3805P” to the left of your count. If your boy are partnered/otherwise a keen RDP, you must be eligible to allege a dependent exclusion borrowing from the bank for the kid. RDPs whom document a ca income tax come back because the married/RDP submitting jointly and possess zero RDP alterations between federal and you may California, combine the personal AGIs off their federal tax statements registered having the brand new Internal revenue service. Make reference to their completed government tax return to done it point.

When the satisfied with everything, the new Irs will establish the level of your own tentative tax to your tax seasons on the revenues effectively associated with your change or business in the us. Typical and you may expected company expenses might be considered if recognized to the brand new satisfaction of your own Commissioner otherwise Administrator’s subcontract. Nonresident aliens who’re bona-fide people of your own You.S Virgin Countries aren’t susceptible to withholding away from You.S. taxation to your money gained when you are briefly involved in the us.

This process enforce a regular periodic rate on the dominating inside the new account daily. Price information – The interest rate on your own membership is actually NaN% with an annual Payment Give of NaN. The attention rates and you will annual payment productivity is changeable and may also changes at any time in the the discretion. Delight just remember that , after you submit an application, unlock a merchant account, or play with our very own services, your agree to become bound by such terminology. Payments out of U.S. tax must be remitted to your Internal revenue service within the You.S. bucks. See Irs.gov/Repayments to own information on how to make an installment having fun with any of your after the alternatives.

The new property manager will fees cleanup charges on top of the examined damage will set you back. Because the a landlord, defense places render a back-up if you are leasing out a house. However, the procedure of gathering places and you will handling dedicated account can make a demanding workload, compelling of a lot landlords to take on shelter deposit alternatives one remove administrative load. Its program can be automate the fresh calculation interesting, upgrade prices for very long-identity clients, and make certain exact symbol of accrued attention on the membership statements.